Struggling after forbearance? It may be time to sell or short sell

/by Marc Dosik

sponsor, guest contributor

The CARES Act of 2020 kicked off two wide-scale relief programs for homeowners facing hardship due to the COVID-19 pandemic: (1) mortgage forbearance and (2) a moratorium on foreclosures. Both programs saved millions of Americans from homelessness and prevented what could have been a devastating housing and humanitarian crisis.

Now that forbearance and moratorium programs have expired, however, tens of thousands of borrowers are behind on their mortgages and at risk of foreclosure. It’s not a fun topic, but it’s an important one to cover.

If you or someone you know is struggling to catch up with mortgage payments after forbearance, now is the time to sell or short sell your home before the bank initiates foreclosure. In this article, we’ll review Covid-related forbearance and moratorium programs and discuss options for selling or short-selling for homeowners in need of a fresh start.

About Forbearance

Despite millions of Americans out of work and a staggering public health crisis, homeowners were able to remain in their homes during the Coronavirus pandemic regardless of whether or not they could pay their mortgage.

A whopping 8.1 million homeowners participated in a mortgage forbearance program, which allowed federally-backed loan holders to pause or reduce their mortgage payments for a defined time period.

To apply for mortgage relief, a homeowner simply needed to request a forbearance from their loan provider. There were no fees, penalties, or proof of hardship required. Per the CARES Act, banks were also prohibited from reporting missed or late payments on borrowers’ credit reports while in forbearance. Though payments were paused, interest continued to accrue and homeowners were still responsible for insurance and taxes due.

At the end of the grace period, homeowners were urged to work out a repayment plan with their mortgage lenders. They were given four options:

Pay back all of the missed payments in one lump sum.

Tack on the missed payments to the end of the mortgage term (called deferral), thereby extending the life of the loan.

Disburse the missed payments over the remaining loan term and pay a higher monthly payment.

Finally, for those with a permanent income loss or reduction – a loan modification. (A loan modification is like a brand new mortgage, with a different interest rate, loan term, and new monthly payment aimed at making the loan more affordable.)

Different rules and allowances apply for different types of loan products (VA, Fannie Mae/Freddie Mac, FHA, private lenders, etc.), but forbearance relief was available in some form or other to homeowners who needed it most.

Initially, forbearance was allowed for up to 180 days, but as the pandemic dragged on and joblessness remained high, struggling homeowners could apply for multiple extensions – in some cases lasting 18 months or more due to special allowances. With few exceptions, these extensions expired as of Jan. 1, 2022. As of May 17, 2022, only 645,000 loans remain in forbearance.

The majority of the 8.1 million participants have exited forbearance and are either caught up with their payments or are enrolled in a payment plan with their loan provider.

However, 295,000 homeowners are still delinquent with their payments and facing foreclosure.

About 65% of these borrowers were actually delinquent prior to the pandemic but the CARES Act’s moratorium on foreclosures stalled all eviction proceedings.

About the Moratorium

The moratorium on foreclosures initiated by the CARES Act put a stop to foreclosure proceedings in most states. This allowed homeowners who were in default on their mortgage payments to remain in their homes for as long as the bill remained in effect – regardless of whether or not their hardship was caused by the pandemic.

Borrowers who were facing imminent foreclosure could then apply for mortgage forbearance. Their credit scores were already affected by any missed or late payments prior to the forbearance period, but the moratorium granted them time to discuss loss mitigation options with their loan provider.

Like forbearance, the federal moratorium was extended multiple times throughout 2020 and 2021 and individual states could tweak or extend the ruling to meet their needs. With few exceptions, the moratorium has officially ended in most states and lenders have once again resumed foreclosure activity.

Selling at a Profit

So you’ve exited forbearance but no longer have sufficient income to pay your mortgage. What now? If you’ve exhausted all your options, it’s time to consider selling your home.

It’s never easy to have to sell your home out of necessity, but the fresh start that it will afford you and your family is more valuable. Especially if you can sell your home with a substantial profit.

Homes gained an average of 20% in equity since the start of the pandemic, and over 32% equity in the last year alone. If you sell your home, you can escape your unaffordable mortgage and avoid foreclosure – all while cashing in on substantial home equity. This amount of wealth could be a significant cushion for you and your family while you get back on your feet.

Selling in a Short Sale

A short sale occurs when you owe more on your home than it would sell for (i.e., your home has negative equity). The bank agrees to forgive the “shorted” amount, allowing you to walk away from an expensive mortgage and avoid foreclosure. Your credit score takes a minor hit, but you can likely re-enter the housing market after 18-24 months of good spending habits.

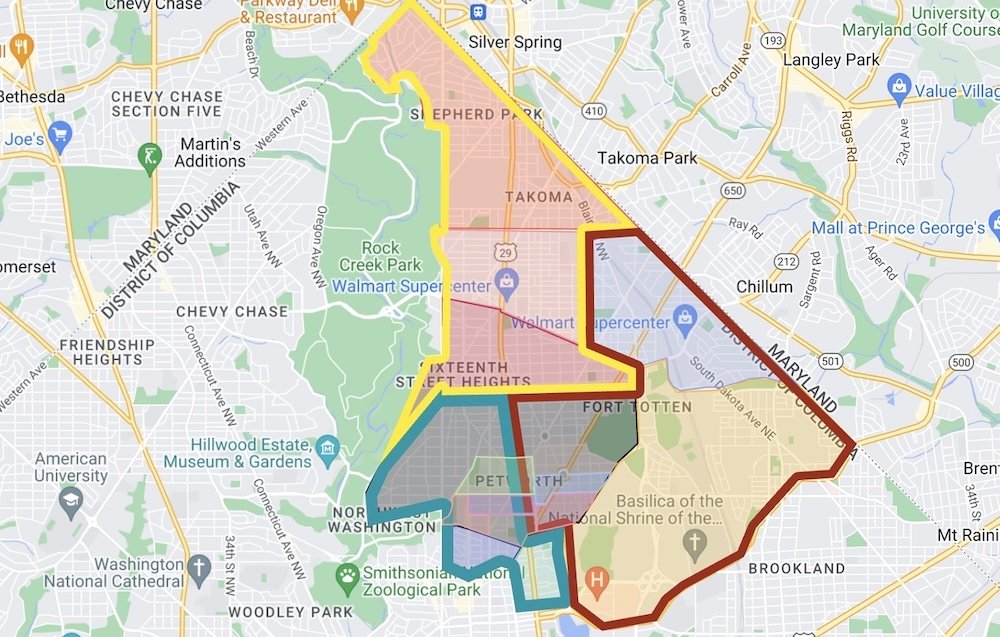

Although most homes have increased in equity during the pandemic, some homes have negative equity due to multiple mortgages, tax liens, or deferred maintenance. If you’re one of the 1.7% of homeowners in the DC metro area with negative equity in their homes and you can’t catch up with mortgage payments after forbearance, a short sale may be your saving grace.

Selling a house as a short sale allows you to avoid foreclosure and walk away free-and-clear from an unaffordable house – all with minimal impact to your credit. Best of all, short sales cost you nothing out of pocket. Your real estate agent and attorney fees are paid for by your lender.

Plus – your short sale team will negotiate with your lender to pay you $3,000 or more in relocation money to you at the completion of the sale. These are all standard practices and lenders are willing to meet these terms in order to avoid a lengthy foreclosure process.

Final Thoughts

Covid relief programs like forbearance allowed distressed homeowners the time they needed to get back on their feet. But government mandates and social distancing had a lasting impact on countless businesses that had to shutter their doors for good. Tens of thousands of individuals have had their incomes permanently reduced or displaced as a result – leaving their housing situation in a precarious state.

Selling a home out of necessity is a painful and emotional process, but the longer you ignore the problem, the harder it becomes to stop foreclosure. You don’t want to go down the foreclosure path. It takes years to rebuild your credit, and that foreclosure will be recorded with the county and remain a permanent flaw on your record.

Selling your home at a profit, or selling in a short sale, on the other hand, will give you flexibility and time to adjust to your new circumstances and work your way back to a comfortable lifestyle.

Have questions about your home? Contact me if you’re thinking about buying or selling a home, we’re here to help!

This is a sponsored article. All images are used by permission.